- by foxnews

- 13 Jan 2025

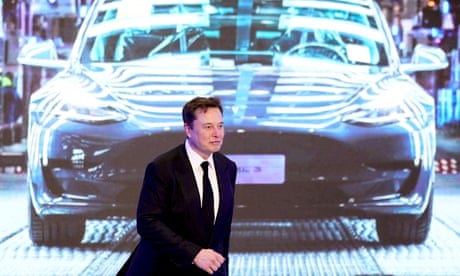

Elon Musk sells $8.5bn-worth of Tesla shares after Twitter deal

Elon Musk sells $8.5bn-worth of Tesla shares after Twitter deal

- by theguardian

- 01 May 2022

- in technology

The Tesla chief executive has committed $21bn of his own money to the funding package for acquiring the social media platform, which he agreed to buy for $44bn on Monday. Since then Musk has sold 9.6m Tesla shares, or about 5.6% of his stake in the business, according to filings with the US financial regulator.

The share sales were confirmed as it emerged that Elon Musk could charge websites a fee for quoting viral tweets from verified Twitter accounts if he completes the acquisition, according to a report.

The Tesla chief executive is also considering a crackdown on executive pay and has a new chief executive lined up to replace the incumbent Parag Agrawal.

In an effort to convince banks to part-fund the takeover, Musk said he planned to grow revenue by developing new features such as charging for embedding or quoting popular tweets, said Reuters. This would involve charging a fee when a third-party website wants to quote or embed a tweet from verified individuals or organisations.

Musk also told banks he could crack down on executive and board pay at the company, according to Reuters, as he sought to convince lenders that he could find the cashflow to service the debt underpinning the bid.

The sale of 9.6m shares, made at prices ranging from $872 to $999 a share, were the first by Musk since a spree late last year that raised more than $16bn, which came after he asked his more than 80 million Twitter followers whether he should sell 10% of his stake in Tesla.

- by foxnews

- descember 09, 2016

Travel tips for attending President-elect Trump's inauguration as experts weigh in

Washington, D.C., is gearing up for travelers ahead of Inauguration Day on Jan. 20, bringing Americans to the nation's capital as President-elect Trump returns to D.C.

read more