- by foxnews

- 19 Nov 2024

TechScape: Inside the $8bn FTX crypto scandal - and its real-world impact

TechScape: Inside the $8bn FTX crypto scandal - and its real-world impact

- by theguardian

- 16 Nov 2022

- in technology

Every week after I finish writing this newsletter, I think: "Next week I'll try not to devote the whole email to a single topic. Some variety is always nice, and there are so many other things to write about."

And then everything keeps happening.

Sam Bankman-Fried, "SBF", was one of the good guys of crypto. He was what everyone wanted a crypto billionaire to be.

A young (30 now, but 25 when he founded his crypto hedge fund Alameda Research), visionary (his desire to earn more, he said, was only because it would enable him to donate to good causes), genius (an MIT undergraduate, gifted high-school mathematician, would wow investors on a Zoom call while playing video games in another tab).

SBF cared about doing things right - he worked with the US Securities and Exchange Commission (SEC) to draw up model legislation for regulating the cryptocurrency sector - and he tried to use his money to improve the world. He promised a billion dollars to the Democratic party, committed to donating vast amounts of his fortune to the "effective altruism" movement, underwrote essay prizes and evangelised for philanthropy. He even managed to keep his good name as the crypto crash started to bite. Where others might have been able to siphon off profit from retail investors, he bought up the shattered remains of consumer-facing non-banks and promised to protect their consumer deposits.

SBF didn't have a string of failed companies behind him; he hadn't built his riches by launching dubious assets and riding a speculative wave to wealth. Instead, he'd managed a career that seemed as close to conventional finance as you could get in the crypto industry. Start with a hedge fund: executing smart and cautious trades to spot market behaviour that can be pushed for a profit. His famous first trade was an attempt to close the "kimchi premium", the persistent difference between bitcoin prices in Korea and America. Profiting is less about noticing it - the differences are plain as day - and more about solving the logistical hurdles: can you get real money from Korea to America, buy bitcoin in the US, sell it at a profit in Korea and repeat it? Can you do it quickly? Can you do it without your accounts being frozen, without being arrested for suspected money laundering and without breaking capital controls?

Then grow your fund until you're big enough that you can start to make money simply by being the largest player willing to commit big sums to crypto. The hedge fund became famous for "yield farming" - profiting from crypto assets that promise a pseudo interest rate to those who hold them - and scale begat scale. He then launched a crypto exchange, because why gamble in the casino when you can run one? Well two, technically: one exchange in the Bahamas, where trading strategies can be attempted unencumbered by American regulation, and one in the US, where a much stricter set of rules allow crypto novices an on-ramp to the sector, sending cash direct from their bank account.

When you're running the exchange, you can step even further back from the unseemly coalface of crypto, profiting merely by taking fees from other people, and cashing in on your strong and stable reputation. FTX was, by some measures, the second largest in the world, and although its offshore nature meant it could never claim to be the cleanest of all the options, it stood in contrast to the larger Binance, run by the more pugnacious Changpeng Zhao (another initialism, known as CZ) who seems still to revel in the ungovernable nature of the sector in a way that SBF never publicly did.

But it was a castle built on sand.

From the outside, the crisis started last week, when CZ took to Twitter to lend credence to some rumours that had been doing the rounds. A document, purporting to be the accounts of Alameda, the SBF-founded hedge fund, had leaked. It showed that the hedge fund's solvency rested, to the tune of several billion dollars, on a token called FTT - the FTX token.

But FTT was just a bet on the solvency of FTX. The token, which was launched and controlled by FTX, was effectively a share in the company: FTX committed to spending a portion of its profits to periodically buy back some FTT, meaning that the richer FTX, the more valuable FTT should be. And the accounts suggested that SBF was printing Disney dollars at one of his companies, and using them to finance the activity of another of them. CZ announced Binance would be selling the FTT, crashing the price of the token in the process.

The short Twitter thread sparked a bank run. On Sunday 6 November, depositors fled to withdraw money from FTX. On Monday, they continued. On Tuesday, the exchange stopped returning funds. The end was in sight. FTX tried to sell itself, turning to Binance and offering a deal that would protect those depositors. But Binance balked, looking at the company's books and walking from the deal.

In a series of emotional posts on Twitter, SBF said he had "fucked up". His problem, he claimed, was a liquidity issue, not a solvency one: if someone asks you to repay a loan, and you need a week to sell your house, you are illiquid. If someone asks you to repay a loan, and your house has just fallen into the sea, you are insolvent. All liquidity issues become solvency ones if the crisis is fast enough; if someone asks you to repay a loan in the next five minutes, and you have to sell your house for cash to the first person to walk past your front door, you probably don't get the full value of your house. The exchange was over. "I fucked up twice," he wrote.

But over the weekend, as the full picture of SBF's empire emerged, it became clear that the problems did not start this week, nor even this month.

A sprawling group of more than 100 related parties, it will take months to fully unpick what the companies collectively known as FTX did and didn't own. But one thing that has become clear remarkably early is that they had far, far less than anyone thought.

On Saturday, the Financial Times published a leaked spreadsheet, put together by FTX on Thursday, listing the company's assets and liabilities. The document showed that the company had less than $1bn in liquid assets, against almost $9bn liabilities, backing up reports from Reuters earlier in the week that SBF had been telling people the company needed $8 to $10bn of inward investment to protect depositors.

The sheet, written in the first person by SBF, was an attempt at vindication, but it just damned the company further. "There were many things I wish I could do differently than I did," he wrote, "but the largest are represented by these two things: the poorly labelled internal bank-related account, and the size of customer withdrawals during a run on the bank."

Without the $8bn hole, and without the $5bn withdrawals on Sunday, the company did look as if it was in better shape: with more than 20 times a normal day's withdrawals on hand, SBF pointed out, rather than the 4 times a normal day that the $8bn hole left, and barely a fifth of what was taken out on Sunday. But other problems were clear. The company's investments were figments. One of the biggest was a token called Serum, valued at more than $2bn on the sheet. But the total value of all Serum in existence has never broken $200m, and today is a quarter of that.

Instead, the valuation (listed as "less liquid" on the sheet) appears to be a calculation based on the "fully diluted market capital", effectively, the value of the token plus all future dividends, which wouldn't be hit for decades. But the value of Serum isn't simply overinflated on the sheet: it's a questionable token for FTX to list in a sheet of assets at all. Ultimately, the value of the token rests on the trust of the organisation that has the power to create it. And the keys to mint new Serum are held by FTX.

There's more to the collapse of FTX, like the "hack" that withdrew half a billion dollars just as accounts were frozen, or the hundreds of millions of dollars withdrawn afterwards due to an order from the Bahamian regulators that the regulators then said didn't exist, but everything keeps happening, so we'll cover it as it does.

Here's an FT profile (�) of the other charismatic bitcoin exchange founder who runs a network of hundreds of companies linked by his common ownership with the flagship exchange nominally headquartered in the Caribbean and largely unregulated.

And if you want to read more about FTX, Dan Milmo and I have written an explainer.

Mastodon is thriving, in a way, even as Twitter isn't. Clive Thompson made the jump, and looks at how the site's foundation differs from its most obvious rival. (I also made the jump.)

I can never read enough about AI art, which I think is - unlike crypto - going to fundamentally change society. But DeviantArt, like many, moved a bit too quickly.

Meanwhile, Tumblr is taking a different tack, embracing cringe as a bulwark against the hordes. And where Twitter sold a blue checkmark for $8 a month, Tumblr sold TWO.

- by foxnews

- descember 09, 2016

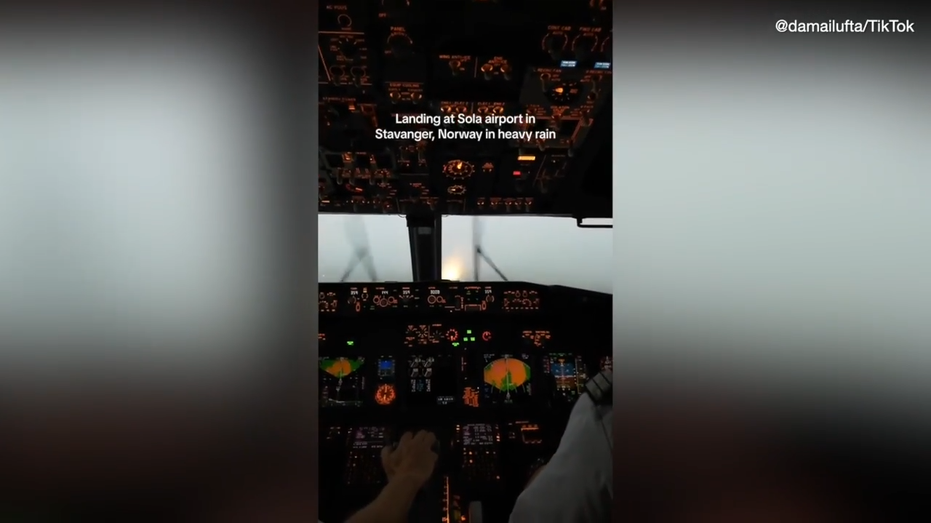

Flight attendant's viral video shows pilots landing in heavy rainstorm

A Norwegian Airlines flight attendant filmed the moment when pilots successfully landed a plane in a heavy rainstorm. The behind-the-scenes footage is now going viral on social media.

read more