- by foxnews

- 15 Jan 2025

Q&A: the collapse of terra and what it could mean beyond crypto

Q&A: the collapse of terra and what it could mean beyond crypto

- by theguardian

- 18 May 2022

- in technology

Critics counter that, more than a decade after bitcoin was created, the sector has yet to spawn an actually useful product, instead merely enabling the creation of a wave of speculative bubbles and zero-sum gambling that has lost some retail investors as much money as it has made for others.

Both sides agree the recent collapse in the crypto market is evidence of waning interest, but the real question is whether it is simply temporary or a more permanent crunch that will expose the sheer quantity of scams and frauds that pervade the sector.

Despite hopes among adherents that cryptocurrencies, particularly bitcoin, would act as a counter-cyclical investment and a hedge against inflation, the sector started contracting at the same time as the wider selloff in tech, with bitcoin slumping from $48,000 in March to less than $38,000 by the beginning of May.

On Friday morning, the DeFi protocol Venus announced it had lost $13.5m from its treasury after it accidentally accepted terra using an out-of-date valuation, while Blizz Finance lost its entire holdings due to the same flaw.

- by foxnews

- descember 09, 2016

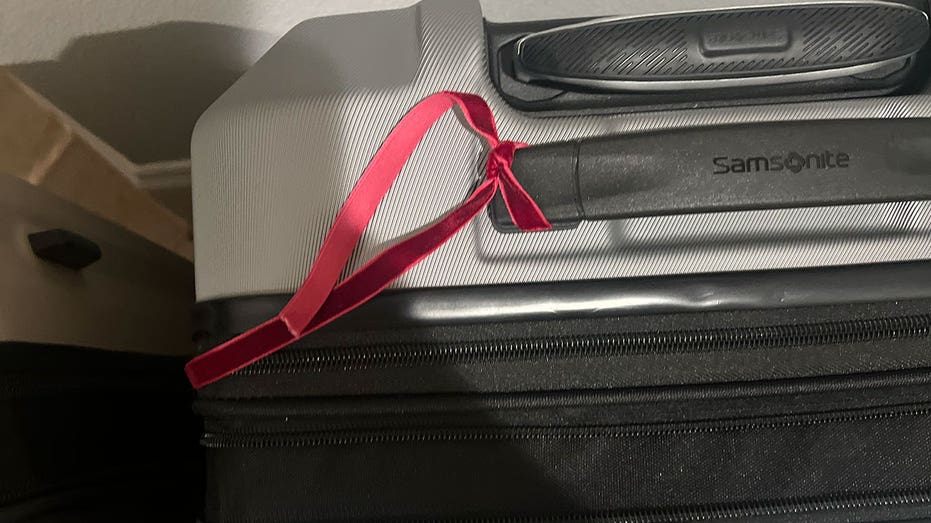

Flight passenger shows luggage resembling prop from airport thriller 'Carry-On,' sparking reactions

A social media user posted a photo of a suitcase tied with a ribbon that appeared to remind people of the new action movie "Carry-On," sparking references in the comment section.

read more