- by foxnews

- 18 Jan 2025

Coinbase’s no-good, very bad summer

It’s been a minute since I checked in on our friends at Coinbase, and so when I saw Reuters noting that a class action suit would be going ahead, I thought perhaps we should all reflect together on Coinbase’s cruel summer.The company’s shares have fallen by more than a third in the last 6 months, to $147.95 as of this writing, from $238.55 on March 6th. On the company’s first day of trading, in April 2021, its closing price was $328.28.Quite a turn of fortune! Certainly some price fluctuation can be chalked up to the vagaries of the cryptocurrency market Coinbase was trading at $153.98 at the start of this year, before a Bitcoin ETF got approved. When Bitcoin began a run in February, Coinbase also started trading up. Still, there

- by theverge

- 07 Sep 2024

- in technology

It's been a minute since I checked in on our friends at Coinbase, and so when I saw Reuters noting that a class action suit would be going ahead, I thought perhaps we should all reflect together on Coinbase's cruel summer.

The company's shares have fallen by more than a third in the last 6 months, to $147.95 as of this writing, from $238.55 on March 6th. On the company's first day of trading, in April 2021, its closing price was $328.28.

Quite a turn of fortune! Certainly some price fluctuation can be chalked up to the vagaries of the cryptocurrency market - Coinbase was trading at $153.98 at the start of this year, before a Bitcoin ETF got approved. When Bitcoin began a run in February, Coinbase also started trading up. Still, there have been some fairly obvious bits of bad news, such as yesterday's ruling.

The class action, briefly put, is about whether Coinbase adequately told its investors about the business's risks from bankruptcy and regulatory agencies. On Sept. 5th, a judge rejected Coinbase's motion to dismiss the suit.

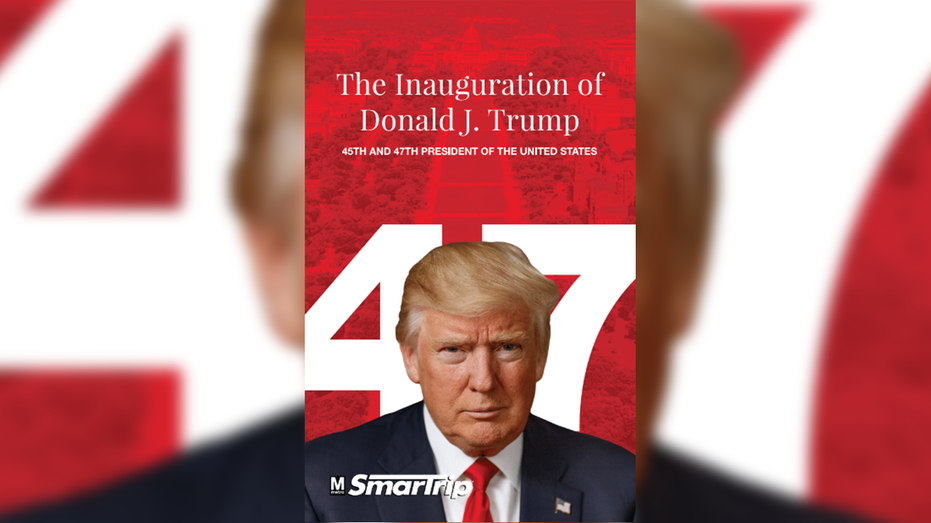

It's also an election year, and crypto money has gotten heavily involved in politics. Given the existential risk the SEC case against Coinbase poses, this strikes me as entirely understandable. Crypto-friendly regulation could short-circuit that risk. But there's been infighting in crypto super PACs, with donor Ron Conway writing an angry memo about being left out of donation decisions.

In that memo, Conway writes, "There is an 'elephant in the room. We have two factions: a moderate faction and a Donald Trump faction (Brian and Marc)." The Brian here is Coinbase's CEO, Brian Armstrong. (The Marc is Marc Andreessen of Andreessen Horowitz.)

Backing Donald Trump maybe looked like a better idea when he was running against President Joe Biden. But now that Vice President Kamala Harris has whipped up enthusiasm from both donors and voters, that decision might be something of an albatross for Coinbase. Perhaps that's why Alesia Haas, Coinbase's CFO, has gone out of her way to say Harris's official super PAC is accepting donations through Coinbase itself. A perception of Coinbase as a Republican company isn't going to give it much leverage in a Harris administration, after all.

There's one more problem with Coinbase's lobbying efforts: a Federal Elections Commission complaint. Crypto critic Molly White and Public Citizen filed a formal complaint that alleged Coinbase violated campaign finance laws. According to the complaint, Coinbase made donations to crypto super PAC Fairshake and to the Congressional Leadership Fund, a PAC meant to elect Republicans to the House, when it should not have been making donations. (Coinbase was, at the time, in negotiations with the United States Marshals Service. The complaint says that federal laws expressly prohibit making donations while negotiating such a contract.) Coinbase has vigorously denied these allegations.

When the hits keep coming like this, I generally get my opera glasses out. Sure, it's possible that Coinbase will win its SEC suit, its shareholder suit, and dodge the campaign finance complaint, as well as manage to navigate the new political landscape of whoever winds up in power after the election. But this seems like a lot of expensive distractions, and an awful lot of uncertainty. Coinbase's top lawyer, Paul Grewal, says he expects a more crypto-friendly Congress. I imagine their shareholders sure hope he's right.

- by foxnews

- descember 09, 2016

This 'hitchhiking' bug can travel on planes, follow passengers home: expert weighs in

A bug expert reveals that traveling is a common way for people to bring home the well-known, parasitic insects that are bedbugs - and yes, they can wind up on airplanes.

read more