- by foxnews

- 09 Mar 2025

Britain’s Tesla hopes for big things from ‘microfactories’

Britain’s Tesla hopes for big things from ‘microfactories’

- by theguardian

- 24 Apr 2022

- in technology

The last year has been tricky for electric vehicle startups. After a burst of investment mania in which companies raised billions on the mere promise of battery propulsion, valuations have come back down to earth.

One of the loudest thuds has come from Arrival, the closest to what could be called a British electric vehicle champion. Its market value on the Nasdaq has fallen from $15bn (�11.6bn) in March 2021, when it first completed a merger with a listed cash shell, to about $1.75bn.

Almost all its startup rivals have suffered similar plunges, but Arrival is arguably a special case. The company is trying to move fast - launching a van, a bus and a car at the same time - and break the traditional industry model, using robot-controlled "microfactories" that it hopes will bounce manufacturers from the Henry Ford age to the iPhone era.

The UK is key to those ambitions, and Arrival - founded by Russian entrepreneur Denis Sverdlov, incorporated in Luxembourg, listed in New York, but with research and development in the UK - is in turn an appropriate symbol for the hopes of the British automotive industry.

Its first products are being developed in Banbury and built in Bicester, both in Oxfordshire, and the company wants Bicester to be the model for microfactories across the world. Now it just needs to make the thing work. That is proving harder than expected: delays mean it has had to halve forecasts for this year to 600 vans.

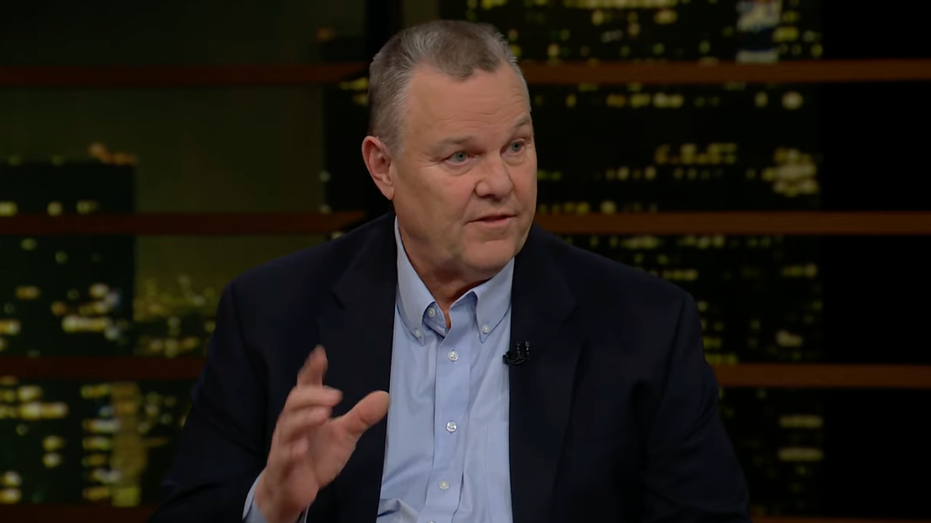

"There are all sorts of people who are wondering if the microfactory will work," says Mike Abelson, chief executive of Arrival Automotive, speaking from the Bicester shed, where half-wrapped robot arms stand poised to start work. "The only way to prove that is to produce the vehicles. We'll be doing that this year, at rate and with quality. I'm very confident."

The factories will cost even less than the �100m Arrival initially suggested when it first emerged from "stealth mode" in 2019; the latest estimate, once it has the model working, is �38m. That pays for a microfactory theoretically capable of 10,000 cars a year - in contrast with the high hundreds of millions of pounds required for a traditional large-scale car plant. Arrival hopes to be able to install a new factory anywhere with a big enough shed (and market) in six to 12 months, compared with an industry that usually moves in seven-year cycles.

"We don't have to forecast four or five years in advance," says Abelson. "This idea that we can react quickly to demand is a big advantage."

Demand is there, if it can deliver. Arrival has 60,000 orders for the van, which will be available with battery capacity options between 67 and 133kWh; the latter would give a 249-mile laden range, says Patrick Bion, an ex-Tesla engineer who is leading work on the van, which starts road trials this spring. Bion took the wheel for a short demonstration in the car park: the van moved quietly and relatively smoothly with a tight turning circle, although an inelegant lurch to a stop showed work was still needed.

Production will be controlled by robots built by a former Nasa roboticist, with autonomous mobile platforms (cheerily named WeMos, short for "wheeled mobility") ferrying the vehicles between six cells with robot arms arranged around them.

The vans are made up of about 30 "Lego block" sub-assemblies, and the process aims to avoid complex and time-consuming joins such as welding. It is the same with the buses, which are made from 1.5-metre modules that can be mixed and matched to add more doors or seats.

The car adds another intriguing direction. Arrival is working with Uber to design a hard-wearing vehicle for taxi-app drivers - although it will be sold on the open market, meaning some retail demand is likely as well.

All the vehicles share many components, such as battery modules, inverters and drive units. They also use plastic composite body panels, which save weight and avoid huge, expensive metal presses. Using such fossil-fuel-based products is an uncomfortable trade-off for a company that makes a big deal of its green credentials, but Arrival says the panels are 100% recyclable.

At its Banbury and Bicester facilities, the company still has a startup atmosphere, with employees gathering for lunch at a canteen right on the factory floor. There is little sense of hierarchy and people roam about - including Sverdlov, who bumps into the Observer briefly, before dashing off to test some prototypes after a nervous greeting.

Later in the day he offers a few more words when our paths cross again. "We do something that's never been done before," he says. "I think we're doing it quite successfully."

Sverdlov has for the most part avoided reporters when he can. He was born in the USSR, in what is now Georgia, and founded a software company in 2000, after graduating from university in St Petersburg. In 2007 he founded telecoms company Scartel, which also made the unusual Yota smartphones. He sold it in 2012 for $1.2bn, before taking a surprising step: he served just over a year in the cabinet of then Russian prime minister Dmitry Medvedev's cabinet as a deputy minister for communications and mass m edia.

The Observer's visit to Arrival took place before Russia's invasion of Ukraine. Sverdlov later said via a spokesperson that his days of moving in Moscow political circles were long past, and that he and his family had lived outside Russia since 2013. He has said that he has never met Vladimir Putin personally, and that he has "no connection to the Russian government in any form".

Scartel's success brought him into contact with Russia's wealthy class. Sergey Chemezov, a now-sanctioned telecoms oligarch and close friend of Putin, was seen as a supporter (but not a shareholder) of Yota, and the company was later bought by sanctioned billionaire Alisher Usmanov's MegaFon. Most notably, Winter Capital, an investment fund founded by Russia's richest man, Vladimir Potanin, holds a small stake in Arrival. Potanin was sanctioned by Canada earlier this month.

Arrival declined to comment on Potanin, but said it was "against war of any kind", in a statement, adding: "Arrival is saddened and concerned, like the rest of the world, about the impact of the situation on any communities involved in the ongoing conflict in the Ukraine."

The company is not reliant on Russian capital or materials. Arrival's biggest investors are household-name companies from around the world, ranging from the world's biggest investor, BlackRock, to UPS - the global delivery company, with which it has a van supply deal - and Korean carmaker Hyundai.

Sverdlov, whose Kinetik fund still controls nearly three-quarters of the company, is clearly very closely involved in running Arrival. He instigated its whole "device on wheels" philosophy, Bion says.

There will be two tests of Sverdlov's success: first and most obviously, can Arrival make money? But second, will other automotive manufacturers be converted to the microfactory model? Even Tesla, the disruptor par excellence, has so far stuck with production lines. Arrival has discussed producing its vehicles on a traditional assembly line with Hyundai, but so far is sticking with the "micro" approach.

"If you take the existing model and apply the microfactory to it, it won't make sense," says Bion. "Other [carmakers] could do it in this way, to simplify, but they don't have the push to do that."

- by foxnews

- descember 09, 2016

'Speaker scum' on flights sparks debate among travelers: 'This is getting out of hand'

A traveler asked social media users to weigh in on flyers who play audio aloud on their devices and don't use headphones.

read more