- by foxnews

- 15 Jan 2025

Number of underperforming super funds reduced and fees cut under Coalition reforms, thinktank finds

Number of underperforming super funds reduced and fees cut under Coalition reforms, thinktank finds

- by theguardian

- 31 Oct 2022

- in news

It also introduced an annual performance test, requiring super funds to inform their members of substandard results.

The government paused the extension of the performance test beyond the basic, low-cost default product MySuper for 12 months.

The Grattan Institute submitted that the performance test had led to under-performing funds merging with better-performing ones.

In its consultation paper, the Treasury questioned whether the test should be extended to trustee-directed products and other choice funds.

The Grattan Institute submitted that the expansion should proceed, citing Productivity Commission and Australian Prudential Regulation Authority (Apra) findings of poor performance and high fees in these products.

The Grattan Institute called for more to be done to force average funds to lift their game, noting those that passed the performance test by a significant margin increased their fees by more than 5% on average.

Despite underperforming funds writing to their members telling them to consider switching, some 90% of members stuck with their fund.

ISA found that the 850,000 members who failed to leave their underperforming super fund lost $1.6bn in 12 months, an average of $1,900 a person.

- by foxnews

- descember 09, 2016

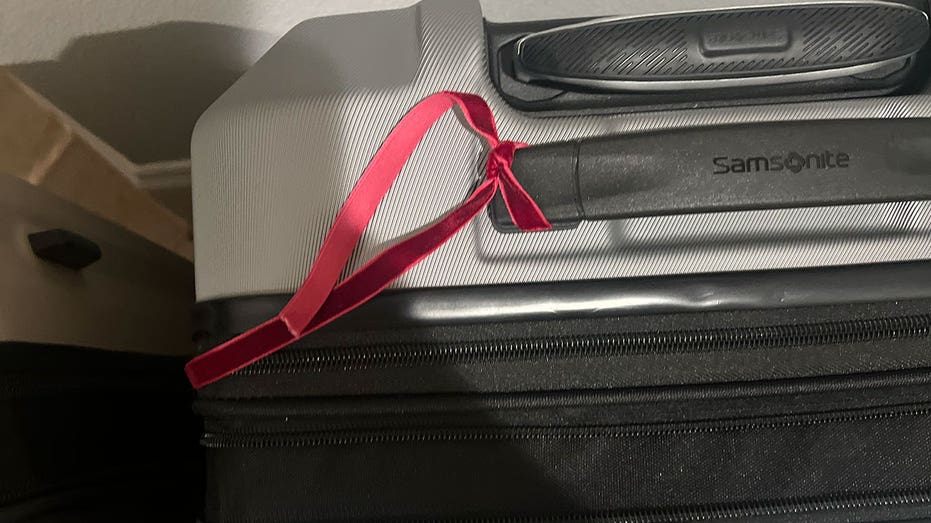

Flight passenger shows luggage resembling prop from airport thriller 'Carry-On,' sparking reactions

A social media user posted a photo of a suitcase tied with a ribbon that appeared to remind people of the new action movie "Carry-On," sparking references in the comment section.

read more