- by foxnews

- 26 Nov 2024

How Biden's SAVE student loan repayment plan can lower your bill

While the Supreme Court struck down President Joe Biden's student loan forgiveness program in late June, a separate and significant change to the federal student loan system is moving ahead.

Eligible borrowers can now enroll in a new income-driven repayment plan that could lower their monthly bills and reduce the amount they pay back over the lifetime of their loans.

If borrowers apply this summer, the changes to their bills would take effect before payments resume in October after the yearslong pandemic pause.

Once the plan, which Biden is calling SAVE (Saving on a Valuable Education), is fully phased in next year, some people will see their monthly bills cut in half and remaining debt canceled after making at least 10 years of payments.

Unlike Biden's blocked one-time forgiveness program, the new repayment plan will provide benefits for both current and future borrowers who sign up for it.

But the benefits will come at a cost to the government. Estimates vary, depending on how many borrowers end up enrolling in the plan, ranging from $138 billion to $475 billion over 10 years. As a comparison, Biden's student loan forgiveness program was expected to cost about $400 billion.

The SAVE repayment plan has gone through a formal rulemaking process at the Department of Education. The agency has previously created several other income-driven repayment plans in the same manner without facing a successful legal challenge.

Some parts of the SAVE plan will be implemented this summer and others will take effect in July 2024. Here's what borrowers need to know.

Currently, there are several different kinds of income-driven repayment plans for borrowers with federal student loans. The new SAVE plan will essentially replace one of those, known as REPAYE (Revised Pay As You Earn), while the others are phased out for new borrowers.

Under these plans, payments are based on a borrower's income and family size, regardless of how much outstanding student debt is owed.

There is also a forgiveness component. After making at least 10 years of payments, a borrower's remaining balance is wiped away.

Borrowers must have federally held student loans to qualify for the SAVE repayment plan. These include Direct subsidized, unsubsidized and consolidated loans, as well as PLUS loans made to graduate students.

Parents who took out a federal PLUS loan to help their child pay for college are not eligible for the new repayment plan.

Borrowers with Federal Family Education Loans, known as FFEL, or Perkins Loans that are held by a commercial lender rather than the government will need to consolidate into a Direct loan in order to qualify.

Private student loans do not qualify for the new SAVE repayment plan or any other federal repayment plan.

Borrowers who are already enrolled in the REPAYE repayment plan will be automatically switched to the SAVE plan once it becomes available later this summer.

Borrowers can log in to StudentAid.gov and go to their My Aid page to see what repayment plan they are enrolled in.

Borrowers who are not currently enrolled in REPAYE can now apply for the new SAVE plan.

The Department of Education says that it will process applications submitted this summer before payments resume in October.

"It may take your servicer a few weeks to process your request, because they will need to obtain documentation of your income and family size," according to the department's website.

Under the SAVE plan, monthly payments can be as small as $0.

Other income-driven repayment plans already offer a $0 monthly payment for some borrowers. But the new SAVE plan lowers the qualifying threshold.

A single borrower earning $32,800 or less or a borrower with a family of four earning $67,500 or less will see their payments set at $0 if enrolled in SAVE.

Increase in protected income threshold: Like in existing income-driven repayment plans, a borrower's discretionary income, generally what's left after paying for necessities like housing, food and clothing, will be shielded from student loan payments.

The new SAVE plan recalculates discretionary income so that it's equal to the difference between a borrower's adjusted gross income and 225% of the poverty level. Existing income-driven plans calculate discretionary income as the difference between income and 150% of the poverty level.

This change will result in lower payments for borrowers.

Interest limit: Under the new payment plan, unpaid interest will not accrue if a borrower makes a full monthly payment.

That means that a borrower's balance won't increase even if the monthly payment doesn't cover the monthly interest. For example: If $50 in interest accumulates each month and a borrower has a $30 payment, the remaining $20 would not be charged.

Lower payments for married borrowers: Married borrowers who file their taxes separately will no longer be required to include their spouse's income in their payment calculation for SAVE. This could lower monthly payments for two-income households.

Automatic recertification: Borrowers will now be able to allow the Department of Education to access their latest tax return. This will make the application process easier because borrowers won't have to manually provide income or family size information. It will also allow the department to automatically recertify borrowers for the payment plan on an annual basis.

Cut payments in half: Payments on loans borrowed for undergraduate school will be reduced from 10% to 5% of discretionary income.

Borrowers who have loans from both undergraduate and graduate school will pay a weighted average of between 5% and 10% of their income based upon the original principal balances of their loans.

For example, a borrower with $20,000 from their undergraduate education and $60,000 from graduate school will pay 8.75% of their income, according to a fact sheet provided by the Biden administration.

Shorter time to forgiveness: Currently, borrowers who pay for 20 or 25 years under an income-driven repayment plan will see their remaining balance wiped away.

Under the new SAVE plan, those who borrowed $12,000 or less will see their debt forgiven after paying for just 10 years. Every additional $1,000 borrowed above that amount would add one year of monthly payments to the required time a borrower must pay.

Borrowers who consolidate their loans will receive partial credit for their previous payments toward forgiveness.

Borrowers will also automatically receive credit toward forgiveness for certain periods of deferment and forbearance, as well be given the option to make additional "catch-up" payments to get credit for all other periods of deferment or forbearance.

Automatically enroll struggling borrowers: Borrowers who are 75 days late on their payments will be automatically enrolled in the best income-driven plan for them, as long as they have agreed to allow the Department of Education to securely access their tax information.

This story has been updated with additional information.

- by foxnews

- descember 09, 2016

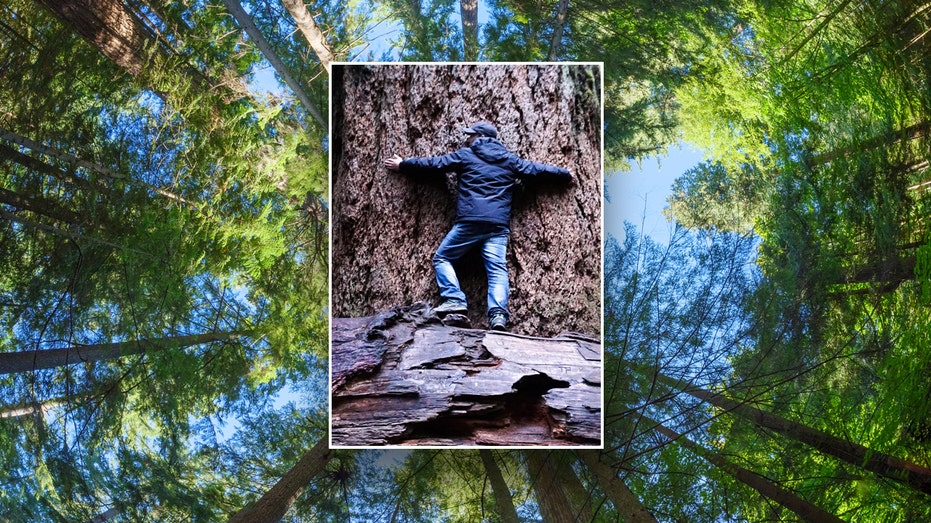

The world's oldest Douglas fir trees have lived over 1,000 years

The Douglas fir, the state tree of Oregon, can grow incredibly tall and live impressively long. The oldest Douglas fir trees have lived to be over 1,000 years old.

read more