- by foxnews

- 22 Nov 2024

Former debt collector reveals Australian industry’s dark secrets

Former debt collector reveals Australian industry’s dark secrets

- by theguardian

- 22 May 2024

- in news

Sean Letcher is a shadow of his former self.

Fifteen long years in the debt collection game, spending his days hounding people for unpaid bills and loans, left him shattered.

"In short - we are treated like slaves, like utter garbage," he says.

He has decided to speak publicly about what he saw in the private debt collection sector - and the shortcomings of a regulatory system he describes as "pitiful" and "a joke" - because he believes the average Australian would be horrified by what really goes on behind the call centre doors.

In 2012, while working for a major Australian debt collector, Letcher remembers being told to attempt to seize a home to pay down a $90,000 debt owed by a Queensland woman who had been raped in the same week her husband had died. The woman was forced to sell her home to pay the debt, he says.

The company does not have records stretching back that far and so couldn't check the allegation, but said it was committed to "treating all customers with respect and in line with the ACCC's debt collection guidelines".

Letcher says at a different debt collection company, he saw "skip tracers" - staff who track down missing debtors - create fake social media profiles to find information about their targets.

That company said it "categorically rejects" the allegations and that Letcher had left the firm because he didn't meet its standards. Letcher disagrees - he says he left because he had ethical concerns about the company.

The former debt collector says regulatory enforcement in the industry is "pitiful" and "nonexistent". He can't remember a single time when he felt as though regulators put pressure on his employers to cease unethical conduct.

"Over my 15-plus years of experience I cannot ever recall feeling the relevant bodies have put any pressures on these companies to act in an ethical manner," he says. "Perhaps something may happen on a case-by-case basis. But who has looked at the entire picture as a whole?"

In one case, he remembers being told to ignore a warning from the ombudsman to cease charging excessive late fees unless a debtor complained.

"The instruction was to aggressively pursue the fees but, at one mention of making a complaint, to just waive the fees," he says.

He also sent an agent to a debtor's child's school and made false threats to debtors that their non-payment would damage their credit rating in relation to debts that could not possibly have that effect, practices that consumer advocates and lawyers have separately raised with Guardian Australia.

"You'll see this used a lot on younger people or the elderly or folks with limited English," he says. "That's debt collection 101."

He speaks of debt collectors harassing friends and family in an effort to have debtors pay. Western Australia's Consumer Credit Legal Services, a community legal centre, has reported similar conduct, saying it is "particularly insidious and unsavoury behaviour and needs to be condemned".

Three sources, speaking on condition of anonymity, have also spoken to the Guardian about what they saw in the sector.

They say many debt collection firms take great care to comply with their legal and ethical obligations and conduct rigorous checks on the way their debt collectors are interacting with debtors.

They didn't witness the type of conduct Letcher spoke of, which is also disputed by his former employers.

But two sources say they have collected for a predatory lender that would deliberately skirt around payday lending restrictions to loan to vulnerable people with little capacity to pay, before charging massive interest while debt recovery processes were ongoing.

A third has spoken of the stress erroneous debt recovery communications could have on vulnerable debtors.

"It causes a lot of stress and those vulnerable ones most of the time called back [and] started abusing all collectors. Occasionally we may get self-harms or threats calls - we got lots of them during Covid."

Letcher says having escaped the industry, he now feels a need to pay penance - or in his words, to "take his medicine".

"I don't hide away from paying my comeuppance, and I realise I owe a debt to the people of this country."

Do you know more? Contact christopher.knaus@theguardian.com

- by foxnews

- descember 09, 2016

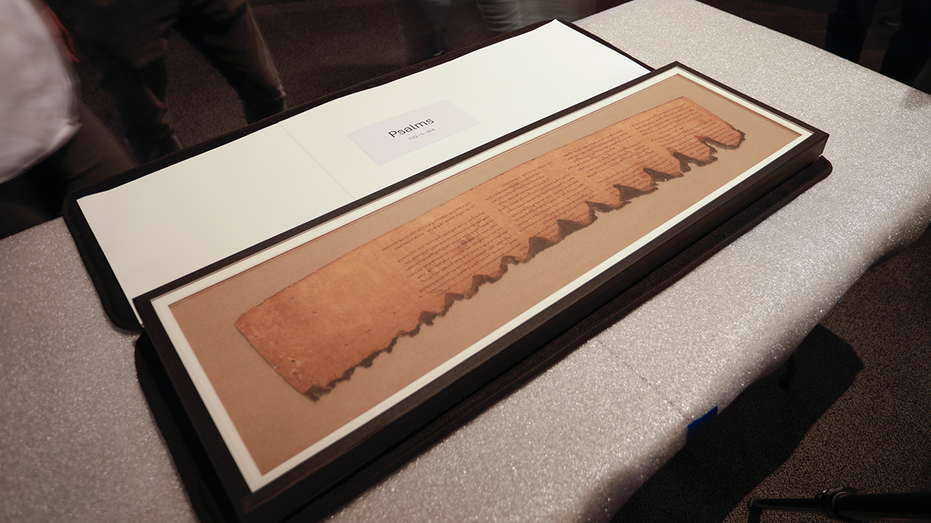

Ancient Jewish manuscripts dating back 2,000 years on display at Reagan Library

The Ronald Reagan Presidential Library in Simi Valley, California, has opened an exhibit featuring a collection of ancient Jewish manuscripts along with 200 other artifacts.

read more